Finance | 12.12.2009

Ending the global money glut without sinking the economy

One of the key factors behind the real estate crisis that helped plunge the world into the so-called "Great Recession" were interest rates that were kept very low for years. While the sickness hit the real estate markets initially, the infection soon spread to the banks and before long the entire global economy was laid low.

The only thing that kept the economy and the banks from a trip to the cemetery was emergency measures enacted by governments in the form of billion-dollar stimulus packages. Central banks administered massive amounts of cash as medicine, which in the end met with success.

However, the consequences of those necessary measures are, once again, low interest rates and an excess of liquidity in the markets - the exact causes of the crisis in the first place.

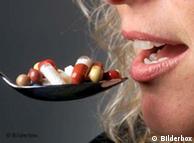

Bildunterschrift: Großansicht des Bildes mit der Bildunterschrift: Just as too many meds can be bad for human, too much cash can harm economies

Bildunterschrift: Großansicht des Bildes mit der Bildunterschrift: Just as too many meds can be bad for human, too much cash can harm economies

In the hospital or doctor's office, prescription drugs given in the right dosage can bring a sick patient back to health. But too much medicine can make that same patient sick. The questions facing doctors is: how much is enough?

To extend the metaphor to the financial crisis, when and how should the support mechanisms propping up once-staggering national economies be pulled away? The answer is: very carefully.

If one stops the drug regimen too soon - reducing the cash infusion and cutting back stimulus programs prematurely - the economy that was on the road to recovery will likely take to its bed again.

But if that same patient takes his medicine too long, the side effects could make him ill all over again.

In short, if interest rates are kept low for too long, new bubbles could appear in the financial markets, bringing with them the threat of inflation and the risk of renewed recession.

Timeline

The crucial factor for deciding when and at what speed to end stimulus programs depends on the state of the economy, according to Michael Heise, chief economist at Allianz, the world's largest insurer.

"We see that the economic recovery in Europe, and globally, is running relatively synchronously and is picking up steam," he told Deutsche Welle.

Bildunterschrift: Großansicht des Bildes mit der Bildunterschrift: Economic stimulus plans were crucial for avoiding another Great Depression

Bildunterschrift: Großansicht des Bildes mit der Bildunterschrift: Economic stimulus plans were crucial for avoiding another Great Depression

Developments on the financial markets appear to back up his opinion. The base rate in the eurozone has been at one percent since May -- the lowest it has ever been. The effective market rate is even below that since the European Central Bank (ECB) has basically made unlimited liquidity available to the financial system.

So while on one side of the economic equation there is a great deal of money floating around, on the other, lending rates are still low since many companies are just now thinking again about investing as the worst of the crisis recedes.

All that excess, cheap money wants to go somewhere and has whetted investors' appetite for speculation - even in high-risk vehicles.

Tapering off

Even as the mood continues to brighten on the financial markets, one should not immediately stop the patient's complete drug regimen, according to economist Heise.

"We should be careful about acting too quickly or rashly and bringing the momentum to a halt," he said, adding that government stimulus programs should be maintained for now, since they will also be needed in the coming year.

"If these programs were cut now, economy would be affected very quickly," he said.

But regarding monetary policy, Heise thinks the expansionary monetary course, increasing the size of the money supply, should be taken down a notch, starting now. That's primarily because there is considerable time lag between changes in monetary policy and their impact on the economy. If interest rates were raised now, he says, it would have hardly any slowing effect on the economy next year.

All together now

The important thing, analysts say, is that members of the international community act together when making changes in monetary policy.

If Europe alone adjusts its policies, reduces the money supply and raises interest rates, the euro could skyrocket dramatically against the dollar and the many Asian currencies that are pegged to the greenback.

Bildunterschrift: Großansicht des Bildes mit der Bildunterschrift: A euro skyrocketing in value against the US dollar would hurt eurozone economies

Bildunterschrift: Großansicht des Bildes mit der Bildunterschrift: A euro skyrocketing in value against the US dollar would hurt eurozone economies

That, however, would pose a big risk to Europe's economic recovery, and for the ECB and other central banks, international agreement on the steps taken is crucial. Scaling back the easy availability of cheap money should be done gradually and with caution.

Several big central banks are now indicating that reducing the money supply is a good idea, but there are few indications so far that action will be coordinated on an international scale. Rather, the tendency now is to protect one's own national currency against an overly rapid rise against the dollar. That is the reason many central banks around the world continue to buy dollars, pouring even more money into the system.

Despite that worrying sign, Heise believes logic will win out in the end.

"I think that there will be a willingness to end this expansive monetary policy when it becomes clear that this economic recovery is relatively stable and that we are no longer in any real danger of sliding back into recession," he said.

Author: Insa Wrede (jam)Editor: Sam Edmon

No comments:

Post a Comment